Small business inventory costs annually can be a major headache for business owners. With the right strategies, however, you can keep these costs under control and maximize your profits. In this guide, we’ll cover everything you need to know about small business inventory costs, from the different types of costs to the best ways to reduce them.

Whether you’re a seasoned pro or just starting out, this guide will help you get a handle on your inventory costs and improve your bottom line.

Types of Inventory Costs

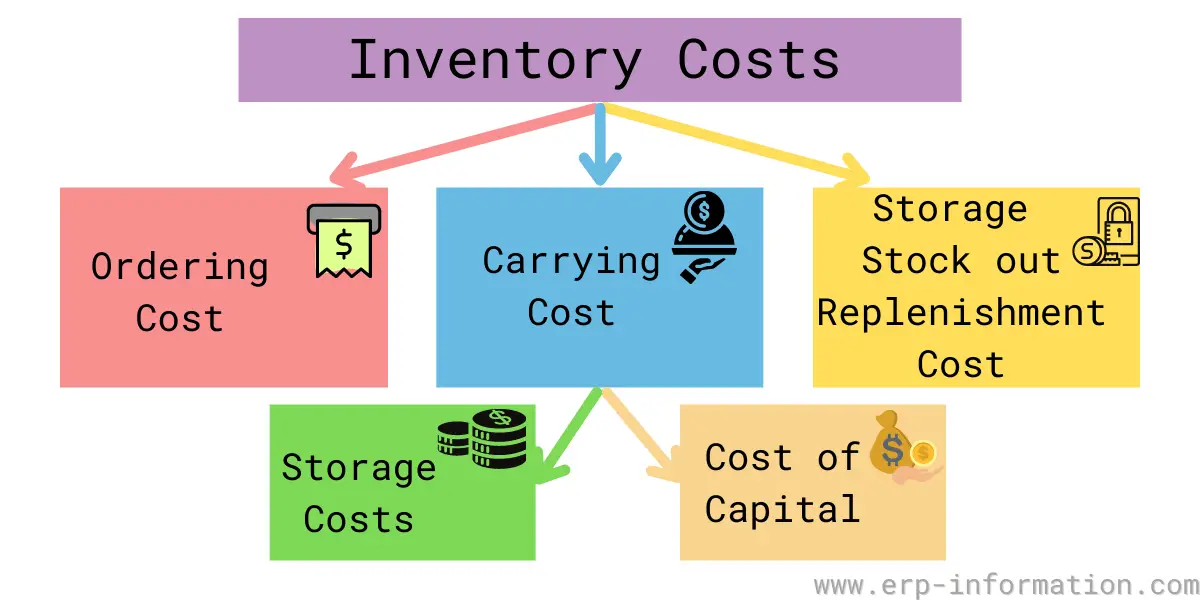

Inventory costs are a crucial aspect of managing a small business. Understanding the different types of inventory costs can help you make informed decisions about your inventory management strategy.Inventory costs can be categorized into four main types: direct material costs, indirect material costs, labor costs, and overhead costs.

Direct Material Costs

Direct material costs are the costs of the raw materials that go into making your products. These costs are directly proportional to the number of units produced. For example, if you make wooden toys, the cost of the wood you use is a direct material cost.

Indirect Material Costs

Indirect material costs are the costs of materials that are used in the production process but are not directly incorporated into the finished product. These costs are not directly proportional to the number of units produced. For example, if you make wooden toys, the cost of the glue you use is an indirect material cost.

Labor Costs

Labor costs are the costs of the labor that is required to produce your products. These costs are directly proportional to the number of units produced. For example, if you make wooden toys, the cost of the labor to cut and assemble the wood is a labor cost.

Overhead Costs

Overhead costs are the costs of running your business that are not directly related to production. These costs are not directly proportional to the number of units produced. For example, if you make wooden toys, the cost of rent for your workshop is an overhead cost.

Inventory Management Methods

Inventory management is like juggling cats – it’s all about keeping them in line and not letting them get tangled up. Different businesses have different ways of doing this, and we’re going to dive into some of the most popular methods right meow!

First-In, First-Out (FIFO)

FIFO is like a queue at the grocery store – the first items that come in are the first ones to go out. This means that the cost of the oldest inventory is recognized first, which can be helpful in times of inflation when the cost of goods is rising.

So, if you’re selling milk, the milk you bought last month will be sold before the milk you bought this month.

Last-In, First-Out (LIFO), Small business inventory costs annually

LIFO is like a stack of pancakes – the last pancake you put on the stack is the first one you eat. This means that the cost of the most recent inventory is recognized first, which can be helpful in times of deflation when the cost of goods is falling.

So, if you’re selling milk, the milk you bought this month will be sold before the milk you bought last month.

Average Cost Method

The average cost method is like mixing a bowl of soup – you add all the ingredients together and then divide by the number of ingredients. This means that the cost of inventory is calculated by taking the total cost of all inventory on hand and dividing it by the number of units on hand.

So, if you have 100 gallons of milk that cost $2 each and 50 gallons of milk that cost $3 each, the average cost per gallon of milk is $2.33.

Specific Identification Method

The specific identification method is like giving each item in your inventory a unique name and tracking it individually. This can be helpful for items that have different costs or that are sold in different locations. So, if you have two boxes of milk, one that cost $2 and one that cost $3, you can track them separately and sell the $2 box first.

Inventory Turnover Ratio: Small Business Inventory Costs Annually

In the realm of inventory management, the inventory turnover ratio reigns supreme as a key metric for assessing a business’s efficiency in handling its stock. This ratio measures how quickly a business sells through its inventory, providing valuable insights into its inventory management practices and overall operational health.

Formula

Calculating the inventory turnover ratio is a straightforward process, involving two primary formulas:

- Cost of Goods Sold (COGS) Turnover Ratio:COGS / Average Inventory

- Sales Turnover Ratio:Net Sales / Average Inventory

The average inventory is typically calculated as the average of the beginning and ending inventory values for a given period.

Inventory Forecasting

Forecasting inventory levels is like predicting the future of your business’s stockroom. It’s a magical power that helps you keep the perfect amount of inventory on hand, avoiding the perils of overstocking (like having too many unsold hula hoops) and understocking (like running out of toilet paper when the zombie apocalypse hits).

There are several ways to forecast inventory, each with its own strengths and weaknesses. Here are a few popular techniques:

Moving Averages

Imagine you’re tracking sales of fidget spinners. Instead of looking at daily sales, you calculate the average sales over the past week or month. This gives you a smoother trendline that helps you predict future demand. It’s like taking the average of your last few grades instead of obsessing over every test score.

Exponential Smoothing

This technique is similar to moving averages, but it gives more weight to recent data. It’s like having a goldfish memory for inventory forecasting, where you remember the last few sales more clearly than the ones from a month ago.

Regression Analysis

This is the fancy pants method that uses statistical models to predict future demand. It’s like having a fortune teller in your back office, but instead of reading tea leaves, they analyze historical data to make predictions.

Inventory Optimization

Inventory optimization is like a magic wand for your business, helping you cast away excess inventory and conjure up just the right amount to meet demand. By optimizing your inventory levels, you can reduce costs, free up cash flow, and make your warehouse a more organized and efficient place.

To optimize your inventory levels, follow these steps:

Steps for Inventory Optimization

- Forecast demand:Use historical data, industry trends, and market research to predict future demand for your products.

- Set safety stock levels:Determine the minimum amount of inventory you need to keep on hand to avoid stockouts.

- Establish reorder points:Calculate the point at which you need to order more inventory to avoid running out.

- Monitor inventory levels:Track your inventory levels regularly and make adjustments as needed.

- Use inventory management software:Automate your inventory management processes to save time and improve accuracy.

Industry Benchmarks

Understanding industry benchmarks for inventory costs and inventory turnover ratios is crucial for small businesses. These benchmarks serve as valuable references against which businesses can assess their performance, identify areas for improvement, and stay competitive within their respective industries.

By comparing a business’s inventory performance to industry standards, owners can gain insights into whether their inventory management practices are efficient and effective. This comparative analysis helps businesses pinpoint potential inefficiencies, such as excessive inventory levels or slow inventory turnover, which can lead to higher costs and reduced profitability.

Industry Benchmarks for Inventory Costs

Industry benchmarks for inventory costs vary depending on the specific industry and business model. However, some common metrics used to measure inventory costs include:

- Inventory Turnover Ratio: This ratio measures how efficiently a business is managing its inventory. It is calculated by dividing the cost of goods sold (COGS) by the average inventory value over a period of time (typically a year).

- Days Inventory Outstanding (DIO): This metric measures the average number of days that inventory is held before it is sold. It is calculated by dividing the average inventory value by the COGS and multiplying by 365 days.

- Inventory Carrying Costs: These costs represent the expenses associated with holding inventory, such as storage, insurance, and handling. They are typically expressed as a percentage of the average inventory value.

Industry Benchmarks for Inventory Turnover Ratios

Industry benchmarks for inventory turnover ratios also vary depending on the industry and business model. However, some common benchmarks include:

- Retail: 4-6 times per year

- Manufacturing: 2-3 times per year

- Wholesale: 3-4 times per year

Epilogue

By following the tips in this guide, you can reduce your small business inventory costs annually and improve your profitability. So what are you waiting for? Start saving today!

FAQ Section

What are the different types of inventory costs?

There are four main types of inventory costs: direct material costs, indirect material costs, labor costs, and overhead costs.

What are some strategies for reducing inventory costs?

There are many strategies for reducing inventory costs, such as just-in-time (JIT) inventory, vendor-managed inventory (VMI), and safety stock optimization.

What is inventory forecasting?

Inventory forecasting is the process of predicting future demand for inventory. This information can be used to optimize inventory levels and reduce costs.